When it comes to navigating the complexities of insurance, understanding kahjuabi can be a game-changer. This comprehensive guide will shed light on its various benefits and uses, empowering you to make informed decisions about your coverage. Whether you’re seeking traffic insurance or health protection for your employees, kahjuabi has options tailored for every need. Join us as we explore what makes kahjuabi essential in securing peace of mind and financial stability in unpredictable situations.

Understanding Kahjuabi: A Comprehensive Guide to Its Benefits and Uses

Kahjuabi refers to a range of insurance services designed to protect individuals and businesses from unforeseen risks. From traffic and liability insurance to health coverage, kahjuabi offers essential financial security. Understanding its benefits is crucial for making informed decisions that safeguard your assets and well-being in various situations.

Kahjuabi

Kahjuabi is a vital service in the insurance industry, providing support and assistance for various claims. It caters to clients needing guidance through challenging situations, ensuring they receive proper care and compensation. By understanding Kahjuabi, individuals can navigate their insurance journeys with confidence and ease.

General Information

Kahjuabi refers to insurance services that provide financial protection against various risks. It covers incidents like accidents, property damage, and health-related issues. With a range of policies available, individuals and businesses can secure their assets effectively. Understanding these fundamentals is essential for making informed decisions regarding insurance coverage.

Client Information

Kahjuabi caters to a diverse clientele, including individuals, families, and businesses. Understanding client needs is crucial for providing tailored insurance solutions. Each policy is designed to meet specific requirements, ensuring clients have the coverage they need in various scenarios. This personalized approach fosters trust and enhances customer satisfaction across all services offered.

Company Information

Kahjuabi is a leading provider of insurance solutions, specializing in various types of coverage. Founded on principles of reliability and customer service, the company has built a reputation for excellence. With a knowledgeable team and innovative tools, Kahjuabi aims to meet diverse client needs across multiple sectors effectively.

Types of Insurance

Kahjuabi offers a variety of insurance types to meet diverse needs. These include Liikluskindlustus for traffic coverage, Kaskokindlustus for comprehensive motor protection, and Vastutuskindlustus for liability. Additionally, Reisikindlustus covers travel risks, while Tööandja ravikindlustus focuses on employee health. Other options are Elukindlustus for life coverage and Kodukindlustus for home protection.

Liikluskindlustus (Traffic Insurance)

Liikluskindlustus, or traffic insurance, is mandatory in many countries. It covers damages caused by your vehicle to others and their property. This type of insurance protects you from financial liabilities resulting from accidents. Having proper traffic insurance ensures peace of mind while driving, knowing that you’re legally protected on the road.

Kaskokindlustus (Comprehensive Motor Insurance)

Kaskokindlustus, or comprehensive motor insurance, covers damages to your vehicle from accidents, theft, and natural disasters. It goes beyond basic liability protection by ensuring repairs or replacements are funded. This type of insurance provides peace of mind for drivers who want extensive coverage against unforeseen events that could impact their vehicles.

Vastutuskindlustus (Liability Insurance)

Vastutuskindlustus, or liability insurance, protects individuals and businesses from legal claims due to negligence or damages caused to third parties. This coverage helps pay for legal fees, settlements, and medical expenses arising from accidents. It’s essential for anyone wanting peace of mind against unforeseen incidents that could lead to significant financial loss.

Reisikindlustus (Travel Insurance)

Reisikindlustus, or travel insurance, offers protection against unexpected events while traveling. This includes trip cancellations, medical emergencies, lost luggage, and travel delays. It ensures peace of mind for travelers by covering unforeseen expenses that can arise during their journeys. Choosing the right policy is crucial for comprehensive coverage tailored to individual needs.

Tööandja ravikindlustus (Employer’s Health Insurance)

Tööandja ravikindlustus provides health coverage for employees, ensuring access to necessary medical services. It helps employers attract and retain talent by offering competitive benefits. This insurance typically covers doctor visits, hospital stays, and preventive care. Providing such benefits promotes a healthier workforce and enhances overall employee satisfaction in the workplace.

Elukindlustus (Life Insurance)

Elukindlustus, or life insurance, provides financial security for your loved ones in case of untimely demise. It offers a payout to beneficiaries, helping cover debts, living expenses, and future needs. Different policies cater to varying budgets and requirements, ensuring peace of mind for you and your family during uncertain times.

Kodukindlustus (Home Insurance)

Kodukindlustus, or home insurance, protects your property from various risks. It covers damages due to theft, fire, and natural disasters. With this insurance, homeowners can secure their investments and gain peace of mind. Policies often include liability coverage for injuries occurring on the premises, ensuring comprehensive protection for families and belongings.

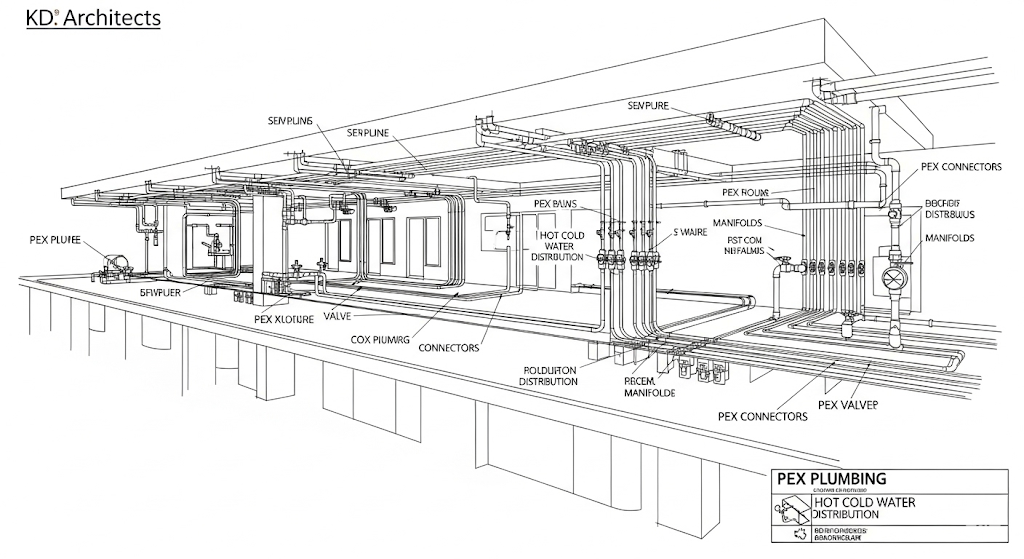

Ehituse koguriskikindlustus (Construction Comprehensive Insurance)

Ehituse koguriskikindlustus provides extensive coverage for construction projects. It protects against various risks, including property damage, theft, and third-party liability. This insurance ensures that contractors and project owners are safeguarded from unforeseen incidents throughout the construction process, allowing them to focus on completing their projects without financial worry.

Benefits and Services

Kahjuabi offers a range of benefits and services designed to meet diverse needs. From comprehensive insurance coverage to expert assistance, clients gain peace of mind knowing they are protected. Additionally, 24/7 support ensures that help is always available during emergencies, making navigating claims smoother and less stressful for policyholders.

24/7 Kahjuabi

Kahjuabi offers 24/7 assistance, ensuring clients have access to support any time of day. This around-the-clock service is crucial for emergencies, providing timely help during accidents or unexpected incidents. Customers can feel secure knowing that expert guidance and resources are just a call away, no matter when they need it.

Reasons to Choose Kahjuabi

Kahjuabi offers tailored insurance solutions to meet diverse needs. Their exceptional customer service stands out, providing guidance through every step. With competitive pricing and a wide range of coverage options, clients enjoy peace of mind knowing they’re protected. Trust in their expertise ensures reliable support when it matters most.

Services Offered by Kahjuabi

Kahjuabi offers a range of services tailored to meet diverse insurance needs. These include claims assistance, policy advisory, and customized coverage solutions. Their expert team ensures clients receive timely support and guidance throughout the claims process. Whether it’s vehicle or home insurance, Kahjuabi prioritizes client satisfaction in every service provided.

How to Handle a Claim

To handle a claim effectively, gather all necessary documents like receipts and reports. Notify your insurance provider promptly. Provide clear details about the incident, including dates and witnesses. Stay organized with communication records and follow up regularly to ensure timely processing of your claim for a smoother experience.

Expert Tips and Recommendations

When dealing with kahjuabi, always read your policy thoroughly. Stay organized by keeping all documents and correspondence in one place. Report any incidents promptly to ensure swift processing of claims. Consider consulting an insurance expert for tailored advice based on your specific needs and circumstances. Regularly review your coverage to stay updated.

Best Practices When Dealing with a Claim

Document everything related to your claim. Take photos, keep receipts, and maintain records of all communications with your insurance provider. Be honest about the incident and provide accurate details. Respond promptly to requests for information and follow up regularly on the status of your claim to ensure timely processing.

Choosing the Right Coverage

Choosing the right coverage is crucial for adequate protection. Assess your specific needs, considering factors like lifestyle and assets. Evaluate each insurance type offered by Kahjuabi, from traffic to home insurance. Compare policies, premiums, and terms carefully to ensure you select the best fit for your unique situation and requirements.

Ensuring a Smooth Claim Process

To ensure a smooth claim process, gather all necessary documentation, such as policy details and incident reports. Communicate clearly with your insurer and respond promptly to any requests for information. Keeping thorough records of conversations can also help expedite the process and resolve issues quickly.

Useful Information

Kahjuabi offers essential resources for clients navigating insurance claims. Familiarize yourself with policy details, coverage limits, and exclusions. Keep emergency contact numbers handy and maintain organized records of all communications related to your claim. Understanding these aspects can significantly streamline the claims process, ensuring you receive timely support when needed most.

Contact Details

For inquiries and assistance, you can reach Kahjuabi via their customer service hotline at (insert phone number). Alternatively, email them at (insert email address) for prompt responses. You may also visit their website to access live chat support or find additional contact information tailored to your needs.

Important Links

Accessing relevant information is crucial for navigating insurance efficiently. Important links can guide you to official resources, claim forms, and customer support. These connections ensure you have the latest updates on policies, benefits, and procedures. Always check these links before making decisions regarding your kahjuabi coverage or claims process.

Legal Information

Legal information regarding kahjuabi includes understanding policy terms, conditions, and exclusions. It’s vital to read your insurance documents thoroughly to avoid misunderstandings. Additionally, familiarize yourself with local regulations that may affect coverage options. Ensuring compliance with legal standards can safeguard your rights as a policyholder and enhance the claims process.

Additional Resources

When navigating the complexities of insurance, having access to reliable resources is vital. Kahjuabi offers a wealth of information that can help you make informed decisions about your coverage options.

Explore their website for detailed guides on each type of insurance and tips for managing claims effectively. Additionally, consider subscribing to newsletters or following their social media channels for updates on policies and industry trends.

For personalized assistance, don’t hesitate to reach out directly via contact details provided on their site. This proactive approach ensures you stay informed and well-prepared in all aspects of your insurance journey.